Nvidia has officially become the most valuable publicly traded company in the world, reaching a market capitalization of $4 trillion on Wednesday, a historic jump powered by the surging demand for artificial intelligence and the chips that fuel it.

Shares of the California-based chipmaker rose 2.5% in early trading to $164, lifting the company above previous market leaders Microsoft, Apple, and Alphabet.

Just two years ago, Nvidia’s stock traded at $14, and it hit the $2 trillion mark only in early 2024 before soaring past $3 trillion in June of the same year.

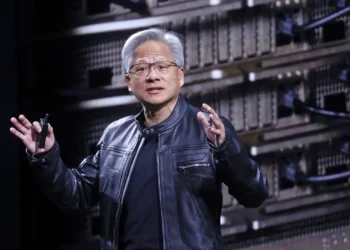

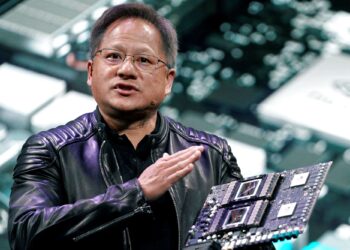

Founded in 1993 by Jensen Huang, Nvidia pioneered the graphics processing unit (GPU) in 1999 —a technology that not only revolutionized gaming and computer graphics but has now become central to the AI revolution. Its GPUs are specially designed to process vast quantities of data simultaneously, making them indispensable to training and running modern AI models like ChatGPT and Google’s Gemini.

Huang, who has called AI “the next industrial revolution,” is now one of the world’s richest individuals. According to the Bloomberg Billionaires Index, he has added $25 billion to his net worth so far in 2025 alone.

Huang’s declaration of the industrial revolution comes as tech giants and startups alike race to adopt Nvidia’s chips for everything from self-driving cars to content-generating tools capable of producing text, images, music, and more.

What to know

The company’s rapid ascent has reshaped the global tech hierarchy. Nvidia now holds the greatest weight on the S&P 500, giving its stock performance outsized influence on broader markets. Its dominance has been a key factor in the index’s record-setting performance, even amid concerns over inflation and renewed economic uncertainty tied to President Donald Trump’s tariff policies.

In its most recent quarter, Nvidia posted $18.8 billion in profit as revenue jumped 69% to $44.1 billion, defying trade turbulence and supply pressures. The company is set to report its second-quarter results next month, with Wall Street anticipating yet another quarter of record-breaking revenue and earnings.

Nvidia’s rise has also played a key role in driving the broader stock market’s gains. Its performance carries significant weight on the S&P 500, and along with other AI beneficiaries, has helped push the index to repeated all-time highs even as inflation concerns and new tariff policies under President Donald Trump cast uncertainty over the broader U.S. economy.

The $4 trillion milestone marks more than just a financial achievement. It signals a shift in global tech leadership and underscores AI’s central role in shaping the future.