The International Monetary Fund (IMF) has removed Nigeria from its list of debtor countries, following the full settlement of outstanding credit obligations to the Fund.

This was disclosed in the latest IMF report titled “Total IMF Credit Outstanding – Movement from May 01, 2025 to May 06, 2025”, published on the multilateral lender’s website on Wednesday.

According to the document, Nigeria is no longer listed among the 91 developing and least developed countries with outstanding credit obligations to the IMF, which collectively owed $117.8 billion as of May 6, 2025.

The total IMF Credit Outstanding across all countries stood at $117,793,823,224 as of May 7, 2025. This figure includes unpaid and outstanding principal from both current and expired arrangements with the IMF.

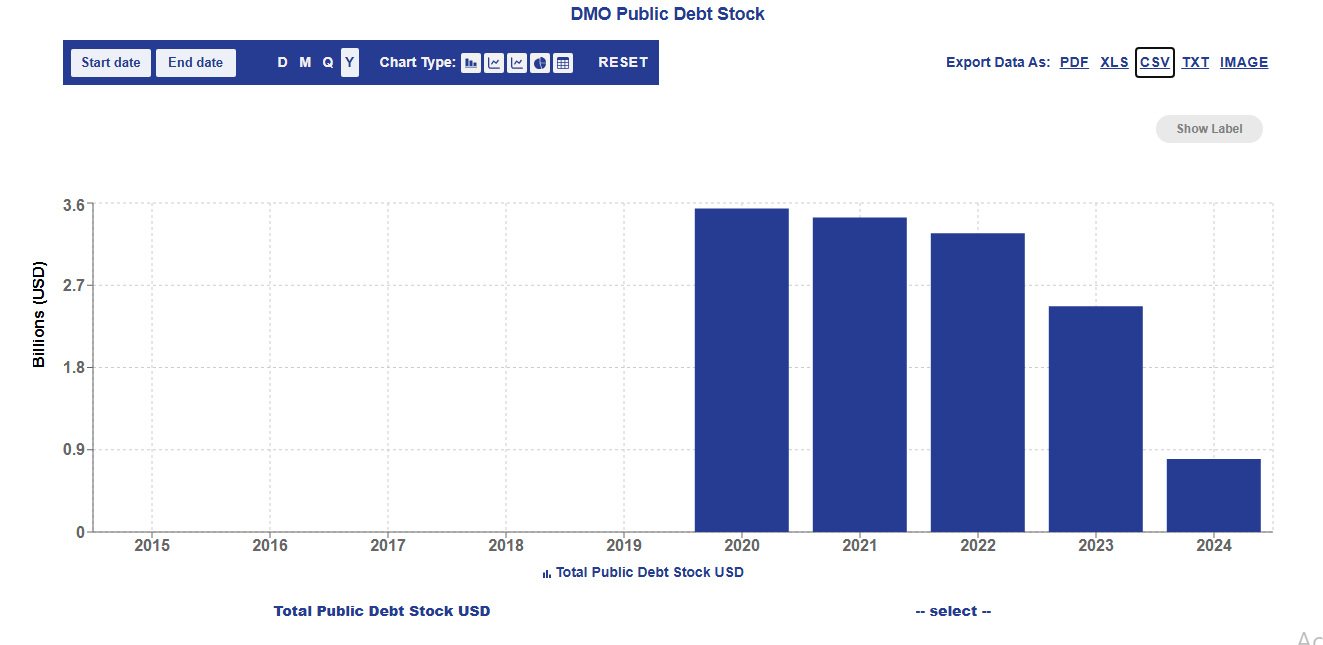

Nigeria’s debt repayment trajectory over the last two years indicates a consistent reduction in obligations to the IMF.

IMF debt trajectory

Data from the Debt Management Office shows Nigeria’s debt to the IMF stood at $800.23 million as of December 2024. It was $3.54 billion as of December 2020 when Nigeria first tapped the loan following the COVID-19 pandemic.

By May 2025, Nigeria had fully repaid its debt to the Fund.

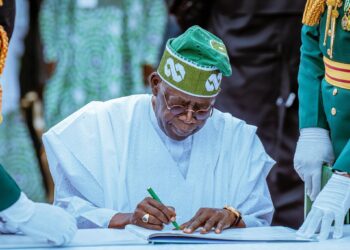

Presidential aide reacts

Reacting to the development, Senior Special Assistant to the President on Digital Engagement, Strategy, and New Media, O’tega Ogra, said the clearance of IMF debt signals a “strategic reset” in Nigeria’s financial management under President Bola Tinubu.

In a post via his official X (formerly Twitter) handle, Ogra noted that the development reflects the administration’s commitment to fiscal discipline, reform, and long-term sustainability.

“As Nigeria closes the chapter on these legacy debt obligations, we are better placed to strengthen our fiscal credibility and show the world—and ourselves—that Nigeria is serious about managing our economy with responsibility and vision,” he said.

Ogra clarified that Nigeria’s exit from the IMF debtor list does not mean it will no longer engage with the IMF or other international lenders. Rather, he said future engagements will be on a more strategic and partnership-oriented basis.

“This is definitely not a door slammed shut. Global partnerships, like the IMF, remain valuable allies, especially in a world defined by volatility and uncertainty. The difference now is that any future engagement will be proactive, not reactive, and based on partnership, not dependence,” Ogra added.

He further emphasized President Tinubu’s commitment to long-term structural reforms and responsible financial stewardship, stating, “Nigeria is rising with clarity, capacity, and credibility, and this is why you should take a #BetOnNigeria.”

In its recent public statements, the IMF has acknowledged Nigeria’s economic reforms, including the removal of fuel subsidies and foreign exchange unification, as bold steps that have helped stabilize the macroeconomic environment and set the stage for sustainable growth.

Why this matters

- Nigeria’s clearance of IMF debt marks a significant milestone in its economic reform programme, analysts say.

- It not only improves the country’s fiscal credibility in global financial markets but also signals a shift in economic policy direction—moving from aid dependence to economic self-reliance.

- Analysts suggest that this development could improve Nigeria’s credit rating, lower borrowing costs, and enhance investor confidence.

- In its recent assessment, Fitch Ratings upgraded Nigeria’s outlook to Stable from Negative, highlighting renewed confidence in the Tinubu administration’s commitment to far-reaching policy reforms.