Last May, Wema Bank surprised many when it announced that it was pioneering the launch of a new digital bank, which it named Alat. It will likely go down as one of the best tech product in the fin tech space in recent years.

Just as most banks invested heavily on mobile banking, Wema Bank went a different route launching a digital bank that many hope would take the industry by storm. Six months down the line, it is about time we take a look at the performance of the app.

How has ALAT fared?

According to information on the website of the company, it has about 100,000 registered users of the ALAT application. A check on the Google Play store reveals that it has about 50,000 downloads.

Users of the app rate it a 4.0 out of a max 5.0 probably indicating that the app is relatively stable. While the ratings appear good, the downloads may appear a bit disappointing, considering the hype as well as the millions that has been spent on marketing and promotion.

Is this good enough?

Most conventional banking apps in Nigeria have users in excess of 500,000. Diamond Bank, which is a tier 2 bank has over a million downloads and is one of the best banking apps around. It is also interesting to note that Wema Bank also has a banking app in the Google Play Store that has just over 100, 000 customers. It will thus appear that Wema Bank Alat seems to be doing well it terms of downloads and when compared to the application maintained by its parent company.

How long can it last?

Alat is a product created for the youth and upwardly mobile Nigerian, particularly those who have a smart phone. It is likely that the company will continue to increase its marketing activities in this segment. It will also hope to continue to improve on the user experience, which it seems to be keen on with the release of version 2 of the app. The application also has favourable reviews on both the iPhone and Google stores, an indication that its customers actually find it useful.

Registration challenges

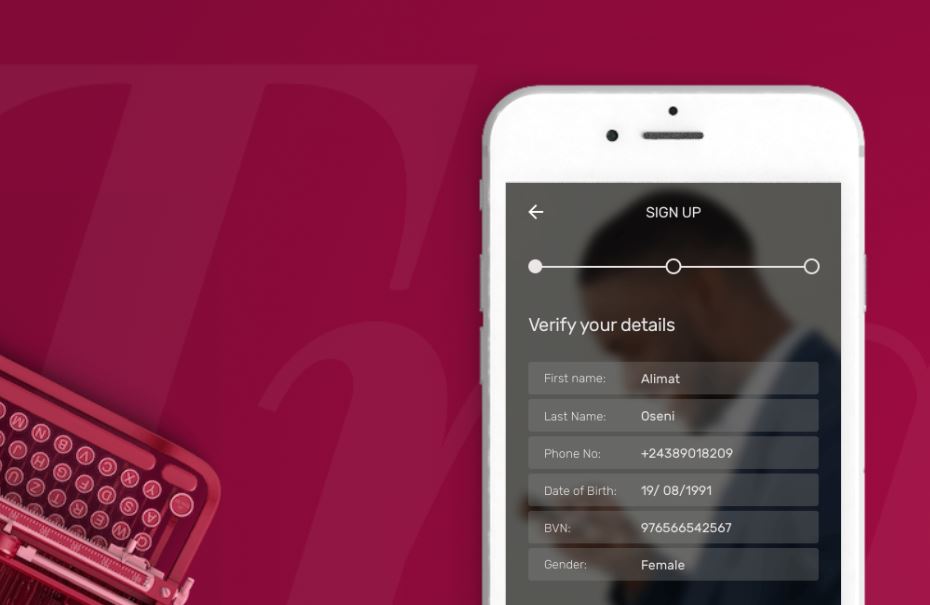

We do however observe some challenges with registration, especially for the un-banked who would still need to visit physical banks to get a BVN if they do not have any. But with a BVN and a valid phone number, it takes about 5 minutes to get the app.

Also, to open a basic ALAT account you will need the app to take photos of your face and signature. This account is also restricted to a balance of 300,000 naira, a single deposit limit of 50,000 naira, and a daily transaction limit of 30,000 naira. When you upload photos of your government-approved ID card and a utility bill, your account will be upgraded to a standard savings account without these restrictions.

These are mostly requirements that you will need to open a physical bank account, a flaw we had mentioned in our previous articles. The transaction limits also dissuades middle class and upper middle class Nigerians from opening one.

Metrics for ALAT

We would expect ALAT to achieve 500,000 active users and at least 250,000 downloads on the app store for us to conclude that it has been a success. Wema Bank does not disclose the performance of its subsidiary in its interim report, so it is difficult to know if it is a project they still have complete faith in.

This Wema bank is already a year and some months and still yet I can’t transfer money always showing me dashboard my other do disturb me like this and your bankers are rude especially the female always jealous of girls wearing human hair

Mehn I just can’t wait to deactivate this account