Nigeria’s subnational debt profile witnessed a significant shift in 2024, as new data revealed that the combined debt stock of the 36 states declined by a massive 32.32% year-on-year, falling from N5.86 trillion in 2023 to N3.97 trillion in 2024.

The contraction signals a renewed focus by several state governments on debt sustainability, budgetary discipline, and alternative financing models amid growing fiscal pressures.

However, despite this broad-based decline, some states remain deeply entrenched in the country’s debt landscape, either due to existing financial obligations or a strategic push for infrastructure-led growth.

Here’s a breakdown of the top 10 states with the highest public debt stock in 2024 and how they compare year-on-year.

Top 10 Most Indebted Nigerian States in 2024

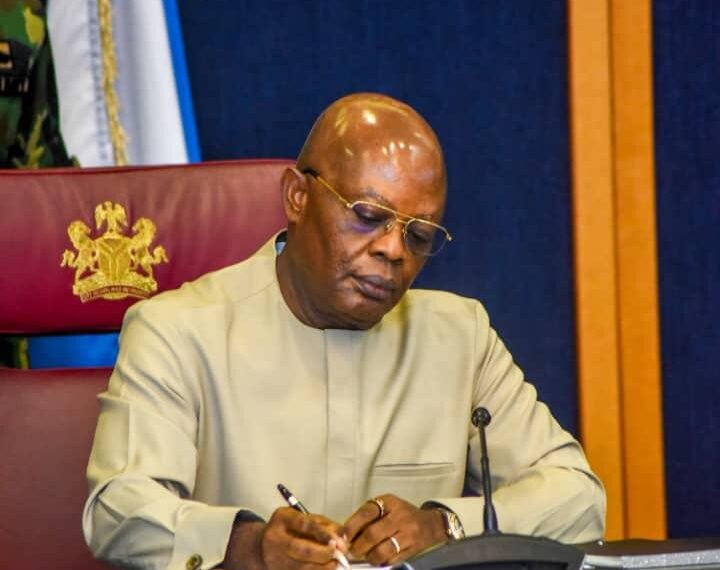

Rivers State posted a massive 56.67% YoY increase in debt, jumping from $232.58 billion in 2023, moving it firmly into second place.

The surge is attributed to post-election capital expansion and liabilities tied to uncompleted contracts. Rivers is one of two Nigerian states with an IGR-to-operating-expense ratio exceeding 100%—at 121.26% in 2024—allowing it fiscal room for aggressive borrowing.

Following the 2023 general elections, Rivers State, like many others, likely launched new capital-intensive projects promised during campaigns. This often leads to increased borrowing to finance roads, flyovers, hospitals, schools, and power projects—particularly when Internally Generated Revenue (IGR) cannot cover costs.

While the debt supports infrastructure development, analysts caution that the state must monitor repayment risks and ensure that new debt translates into real economic value.